The idea that Jews are innately good with money is among the oldest Jewish stereotypes, one that continues to impact perceptions of Jews today. In China, books touting the supposed secrets of Jewish financial success have been best-sellers, while all over the world anti-Semites have long railed against Jews’ purported control of international banking.

While the notion that Jews control the world economy or banking system is an obvious canard, it is true that Jews have long been well-represented in the fields of finance and business. This is commonly attributed to the fact that for centuries, Jews were excluded from professional guilds and denied the right to own land, forcing them to work as merchants and financiers. However some academics contend that the historical evidence does not support this thesis and that Jewish financial success is instead due to the community’s high literacy rates.

Whatever its causes, Jewish business and financial success has more often than not been a major driver of anti-Semitism. Shakespeare’s Shylock character, a money lender who extracts a pound of flesh from a debtor who defaulted, is among history’s best-known caricatures of the Jewish businessman. That caricature lent a sinister undertone of greed and exploitation to Jewish financial dealings that would be invoked to justify anti-Jewish measures for centuries to come. Supposed Jewish control of the global financial system — a feature of what some call economic anti-Semitism — was a major theme in Hitler’s war against European Jews, Father Coughlin’s anti-Semitic rants in the United States, and the czarist forgery The Protocols of the Elders of Zion. Related slurs include claims that Jews are wealthy, greedy and stingy, obsessed with material goods and profit, and that they exploit their economic advantages to help their own people, to the detriment of the public good.

Origins of the Jews and Money Stereotype

With your help, My Jewish Learning can provide endless opportunities for learning, connection and discovery.

Jews have been associated with moneylending for at least a millennia. The most common explanation for this has been the exclusion of European Jews in the Middle Ages from various guilds, their confinement to ghettos and restrictions preventing them from owning land. Additionally, medieval Christian theology held that charging interest (known as usury) was sinful, which kept many Christians from becoming financiers. The field thus came to be dominated by Jews. The historian Howard Sachar has estimated that in the 18th century, “perhaps as many as three-fourths of the Jews in Central and Western Europe were limited to the precarious occupations of retail peddling, hawking, and ‘street banking,’ that is, moneylending.” The fact that Christians regarded such occupations as incompatible with their religious principles fed the notion that Jews were morally deficient, willing to engage in unethical business practices that decent people had rejected.

An alternative explanation holds that the Jewish penchant for finance is a result not of professional exclusion, but the Jewish emphasis on learning and literacy. A number of scholars have posited versions of this thesis. In their 2012 book The Chosen Few: How Education Shaped Jewish History, 70-1492, economists Maristella Botticini and Zvi Eckstein contended that, with the destruction of the ancient temples in Jerusalem and the beginning of the Jewish Diaspora, Jewish continuity suddenly became dependent on widespread religious literacy. Those who educated themselves remained Jews, whereas those who did not assimilated or converted to other faiths. Over time, the Jewish community evolved into a uniquely educated population, which in turn incentivized Jews to abandon farming in favor of better-paying professions and businesses.

Evolution of a Stereotype

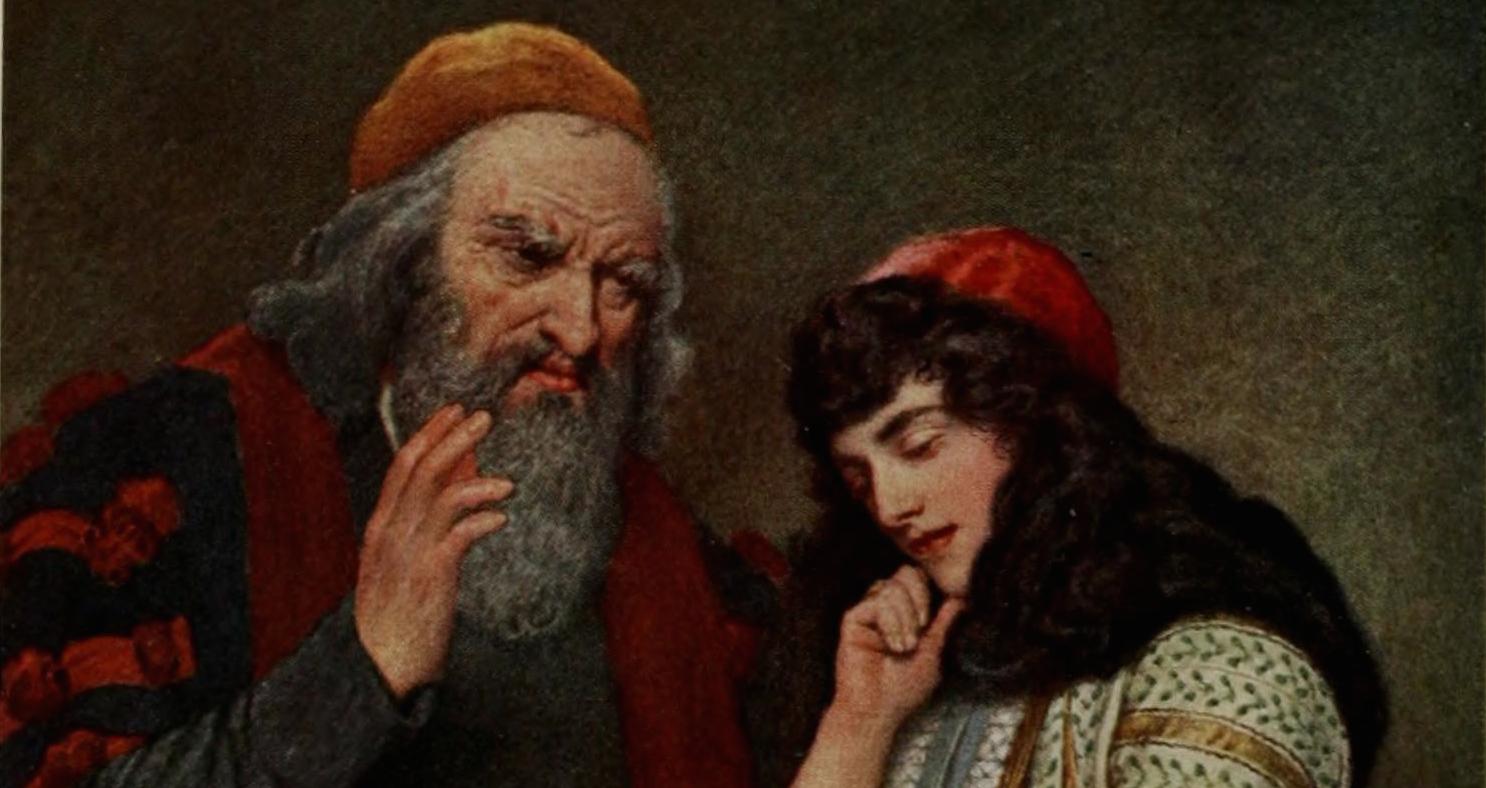

From the fact of Jewish overrepresentation in occupations that Christians largely regarded as degenerate emerged a stereotype of the Jew as the embodiment of commercial greed, exploiter of the poor and the source of economic pain and misery for the masses. Perhaps nothing did more to solidify this image in the European imagination than The Merchant of Venice. In this play, written in the late 16th century, Shylock is a Jewish moneylender who extends a loan guaranteed by a pound of flesh from the Christian merchant Antonio. When Antonio’s ships are lost at sea and he cannot repay the loan, Shylock summons him to court where, despite being offered twice the original loan as repayment, he insists on exacting his pound of flesh, which he plans to obtain by lopping it off Antonio’s body with a knife.

Though scholars disagree whether Shakespeare was reflecting the ingrained anti-Semitism of his day or offering a subtle critique of it, Shylock has become synonymous not merely with Jewish greed but with anti-Semitism generally, a perception deepened by early onstage portrayals of the character as a vengeful villain. Shylock had a lasting influence on the depiction of Jews in English literature and was used as a propaganda device by the Nazis. Dozens of productions of The Merchant of Venice were mounted in Nazi Germany in the 1930s.

Jews did hold prominent financial positions in Europe, which made them ready scapegoats in times of economic crisis. For centuries, so-called court Jews acted as the principal financiers for the European aristocracy’s projects. In the 1760s, one of those court Jews, Mayer Amschel Rothschild, established a banking business in Germany that would eventually grow into a vast international conglomerate and yield one of the largest family fortunes in world history. The Rothschild name became synonymous with Jewish financial power, invoked as shorthand for the secretive and outsized power Jews were alleged to wield over the economic fate of the world. Despite his own Jewish ancestry (his parents converted the family to Protestantism when he was a child) Karl Marx, the philosopher who first popularized the idea that capitalism is inherently exploitative, singled out Jews in particular for their role in promoting it.

As moneylending evolved into institutionalized banking, Jews continued to occupy major positions in the financial world. Across Europe in the 18th and 19th centuries, Jews built a number of influential banks, further feeding anti-Semitic conspiracy theories. With mass Jewish immigration to the United States beginning in the late 19th and early 20th centuries, Jews assumed prominent positions in the growing financial center of New York, establishing Salomon Brothers, Lehman Brothers, Goldman Sachs and others. They also figured prominently in government financial positions. Between 1987 and 2014, the U.S. Federal Reserve was chaired by a succession of three Jews. Four of the eight men who served as U.S. Treasury secretary between 1995 and 2020 were Jewish. Three of the 12 presidents of the World Bank between its founding in 1946 and 2020 have been Jewish. Jews are also significantly overrepresented among the wealthiest Americans. Half of the 10 richest Americans in 2016 were Jewish, according to Forbes, despite Jews making up less than 2 percent of the U.S. population.

As a result, talk of “international bankers” is still widely regarded as a veiled form of anti-Semitism. When Donald J. Trump, campaigning for the presidency in 2016, charged that his rival, former Secretary of State Hillary Clinton, “meets in secret with international banks to plot the destruction of U.S. sovereignty in order to enrich these global financial powers,” some saw an evocation of anti-Semitic stereotyping. Jonathan Greenblatt, CEO of the Anti-Defamation League, urged Trump in a Twitter post to “avoid rhetoric and tropes that historically have been used against Jews and still spur #antisemitism.”

Contemporary Manifestations

Not all invocations of Jewish financial prowess are malicious, and some are deeply admiring. In China, eagerness to mimic Jewish business success has driven a recent publishing trend purporting to reveal the secrets to wealth contained in ancient Jewish texts. Crack the Talmud: 101 Jewish Business Rules, 16 Reasons for Jews Getting Wealthy, The Secret of Talmud: The Jewish Code of Wealth and Secret of Jewish Success: Ten Commandments of Jewish Success have all been published in China in recent years.

In the West, however, talk of Jewish prominence in finance is more frequently pernicious. David Duke, the former KKK grand wizard, has repeatedly inveighed against Jewish “domination” of media and banking (along with the pornography industry and efforts to “de-Christianize” America). Eustace Mullins, a Holocaust denier who died in 2010, argued in several published works that the Federal Reserve was created by three Jewish “enemy aliens” to take over the American monetary system. The anti-Semitic website Jew Watch includes a page listing “International Banks & Jews Who Founded Them.” Louis Farrakhan of the Nation of Islam has long claimed that Jews control the international financial system.

Such ideas have also been internalized by the general public. According to studies conducted by the ADL, substantial percentages of respondents in virtually every country surveyed believe Jews have too much power in business and international financial markets. Roughly half of respondents in France agreed with that idea, as did one-third of Germans and nearly three-quarters of Egyptians. Even in the United States, where anti-Semitism is fairly low by global standards, some 18 percent of respondents said Jews have too much power in the business world.

Given that Jews are well represented in banking, how does one recognize the line between acknowledging this fact and dealing in pernicious anti-Semitic canards? Writing after actor Seth MacFarlane drew criticism for joking at the Academy Awards that it’s best to be Jewish if you “want to continue to work in Hollywood,” journalist J.J. Goldberg offered one way to draw that line. As with the Jews and finance stereotype, MacFarlane’s bit was based in inarguable fact — by Goldberg’s count, more than 80 percent of top Hollywood studio chiefs are Jews. According to Goldberg, such talk veers into anti-Semitism when one speaks of “the Jews” controlling movies — the implication being that a corporate entity known as “the Jews,” acting as an organized group, is conspiring to exert its authority. It’s undeniable that Jews are disproportionately among the wealthiest Americans and overrepresented in top positions in the financial world, but it’s anti-Semitic, according to Goldberg, to say that “the Jews” are.